PARUL – MBA – Accounting For Managers

Q. 1 “Managers need to have an understanding to accounting.” Discuss the statement concerning users to accounting information. The topic is crucial in understanding concepts in Accounting for Managers.

Q. 2 Classify the following accounts under the traditional approach.

Building Capital

Purchases Drawings

Sales Personal income-tax account.

Rent Interest Receivable account

Cash Dividend received

Trade receivables Discount allowed

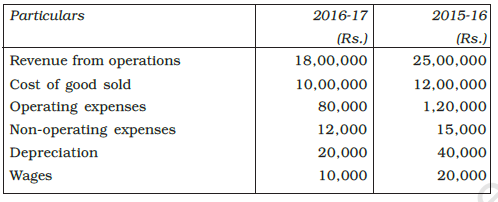

Q. 3 From the following information, prepare a Common size Income Statement for the year ended March 31, 2016, and March 31, 2017. This is an important task in Accounting for Managers.

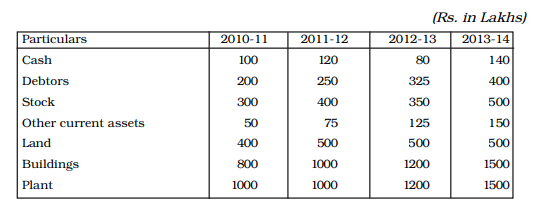

Q.4 From the following data relating to the assets of the Balance Sheet of ABC Ltd., for the period ended March 31, 2011, to March 31, 2014, calculate trend percentages. This exercise is vital when learning Accounting for Managers.

Q. 5 How can we calculate cash flow from operating activities? Explain this with a hypothetical example. Understanding this concept is central to Accounting for Managers.

Q. 6 Classify the following cash transactions into i) Cash from Operating Activity; ii) Cash from Investing Activity; iii) Cash from Financing Activity: –

1) Dividend paid to shareholders

2) Payment made to supplier

3) Interest income on Debenture

4) Dividend Received

5) Taxes Paid

6) Salary Paid

7) Purchase of Shares

8) Issue of Shares